Temporary car insurance for hours, days, or weeks

Temporary car insurance is a clever way to drive a car without being added as a named driver, or rushing into an annual policy.

Policies are fully comprehensive and last hours, days or weeks. It's quick and easy to get a quote in minutes and policies can start instantly.

12 million+ policies sold

2 million+ cars insured

How long does temporary car insurance last?

Policies can last from 1 hour to 28 days, so it’s totally up to you. You'll get fully comprehensive insurance for as long as you need, whether it’s hours, days or weeks.

Hourly car insurance

Hourly car insurance is perfect for sharing a long drive, moving a car, test driving a car, borrowing a friend's car for a short period, or driving one home from the dealership so you’ve got more time to sort an annual policy.

Daily car insurance

Daily car insurance is great for when you’re moving house, taking stuff to the dump, or for those all-important trips to IKEA (meatballs not included). It's also a quick and easy option if you're visiting family and want to borrow a car from a family member. Broken down by hour, they’re much better value than hourly policies.

Weekly car insurance

Weekly car insurance might be good if you’re borrowing a car or van regularly. It’s also perfect for using your parents car when visiting home, sharing a car on campus or even driving the North Coast 500. The best value, when broken down by hour.

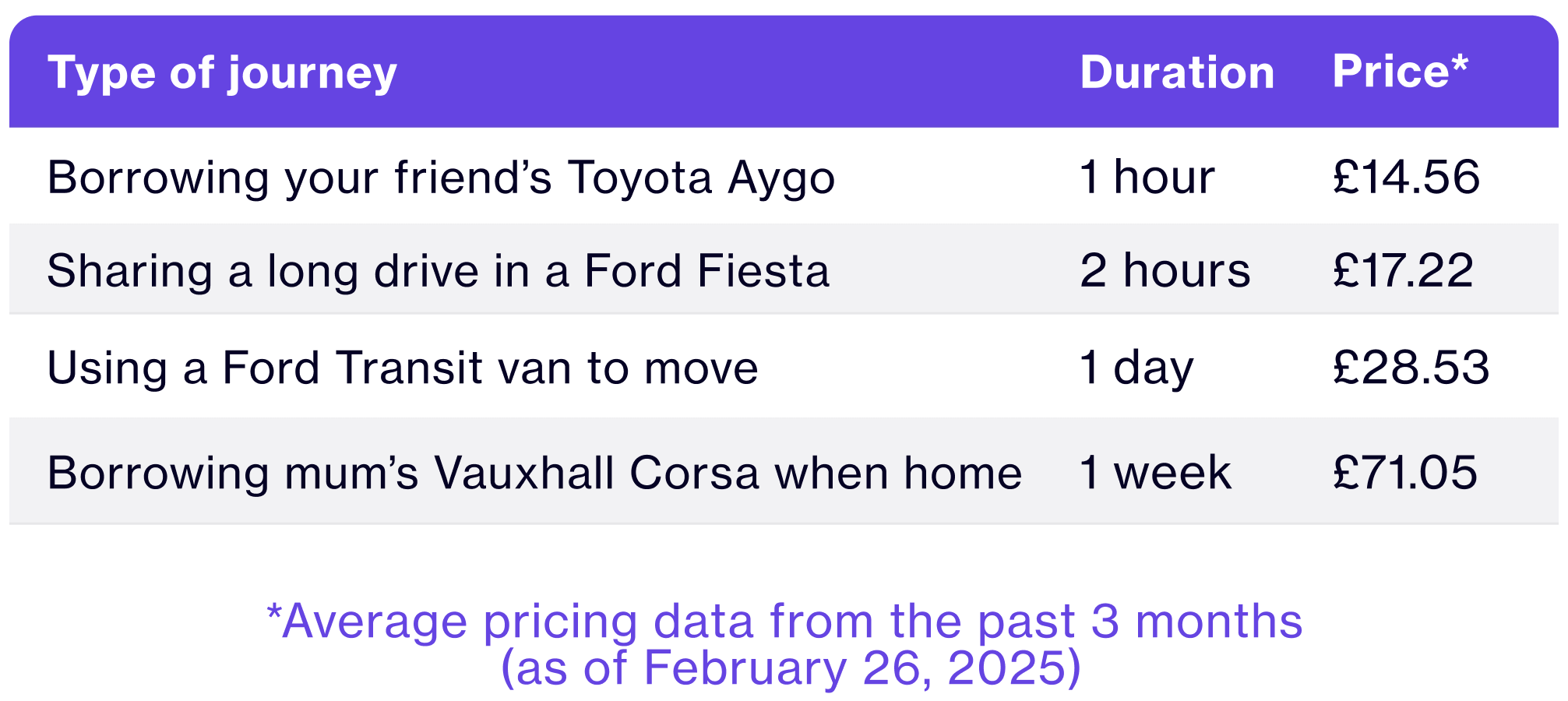

How much does temporary car insurance cost?

The price of temporary insurance depends on a lot of different factors, like your age, job title, the car you drive, and where you live. So your price will be unique to you. But we know it can be helpful to get a ballpark figure, so here are some quick ones: 1 hour policies start from £12.55, 1 day policies start from £18.14 and 1 week policies start from £43.47*.

But every journey is different, so here are some other examples, using average pricing data from the past 3 months (as of February 26, 2025).

What's covered by temporary car insurance

Cuvva's short term car insurance policies are fully comprehensive when driving in Britain, so you can have total peace of mind. Here’s a little more info:

What you're covered for

Damage to your vehicle up to £60k

Damage to third party property up to £2m

Accident, theft, attempted theft or fire

Social Domestic and Pleasure (SDP), commuting, Class 1 Business use and Carriage of own goods

Up to £500 for after-fit audio equipment and £100 for your things

£150 for a child seat

Driving in the EU, plus Andorra, Iceland, Liechtenstein, Norway, Serbia and Switzerland. This is third party cover only (which covers damage to the other person’s car), and policies must start and end in Britain.

What you're not covered for

Insuring rental cars

Putting the wrong type of fuel in your car

Impounded car release

Driving vehicles under fleet policies

Racetrack or rally day driving

If the car is stolen with keys left in the ignition

Someone else driving your car uninsured

The expert's view on temporary car insurance

Adam Kent is our Senior Underwriting Lead and Insurance Expert. He joined in 2022 and has a 19 year track record helping insurtechs, brokers, and direct insurers.

When it comes to temporary car insurance, he says: “In the past, if you needed to borrow someone’s car, it meant tedious phone calls, an expensive insurance policy for longer than you need, or more often than not, just staying where you were because you couldn’t get insured in time.”

“Temporary car insurance has changed all that. It’s now practical, affordable and easy to drive a car for a short time.

“There’s another upside, the big rise of short-term policies may even help bring down the cost of insurance. £500 million is paid out in claims relating to uninsured driving every year. And we all end up paying for this in higher premiums. Open the app, get yourself covered, and sorted in minutes.

How to get temporary car insurance fast

How to get Cuvva’s award-winning car insurance in less than 5 minutes:

1

Download the app

It just takes a few clicks

2

Find your car

By entering the number plate

3

Check your cover and pay

Get insured from 1 hour to 28 days

4

Extend with a few taps

If you need more time than you thought

Check your eligibility for temporary car insurance

Want to check Cuvva’s eligibility criteria for temporary car insurance? Here’s everything you need to know:

Driver eligibility

For full UK driving licence holders, you’ll usually need to be aged 19-70 to use Cuvva, and have held your licence for over a year if you're a newer driver

If you’re a provisional licence holder you’ll need to be aged 17-50 and not have held your licence for over 15 years

To use Cuvva, you can either use a UK licence or use a full driving licence from Belgium, Bulgaria, France, Germany, Greece, Italy, the Netherlands, Poland, Portugal, the Republic of Ireland, Romania, Spain, or Sweden

Your car must

Be at most 40 years old (if you're driving a car on a full licence) or at most 20 years old (for learner licences, or vans)

Be worth less than £60,000 (cars), or be worth less than £40,000 (vans/commercial vehicles)

Meet our modification rules. We accept lots, including any to aid a disability, but there are some we can't insure

Meet our insurance group requirements

Not be scrapped or impounded temporarily

Not be a company car, a hire car or a vehicle on a fleet policy

How temporary car insurance works

Flexibility

Buy an instant policy in minutes or book one in advance so you’re ready to drive later

Extend your policy instantly if you need more time on the road

Choose a policy length from 1 hour to 28 days, all sorted via the app

Get your policy docs (your car insurance certificate) sent straight to your phone - no waiting around for paperwork to arrive

No deposits, interest, tie-ins or credit checks

Peace of mind

Fully comprehensive cover - the highest category of insurance available

Car owner's no claims bonus is protected because the driver’s policy is completely standalone

Cover for damage to the vehicle, damage to other people’s vehicles, personal injury plus more

Add 24/7 breakdown cover for an additional 90p for a 1 hour policy, £3.96 for 1 day, or £11.10 for 1 week

365-day help from our tireless customer support team

Insurance for all

Learner driver insurance to nail those manoeuvres as you practice for the driving test

Temporary van cover to lighten the load

Test drive insurance for checking out a potential purchase before you buy

Drive away insurance to get that new car home without having to worry about sorting annual cover right away

And you can borrow a car or lend out your own whenever you want

Temporary car insurance FAQs

Is temporary car insurance legal?

It’s completely legal. Like annual insurance, temporary policies are listed on the same askMID database that the police use for their ANPR detection technology. It's all fully legit and regulated (our FCA number is 690273, if you want to look it up). Learn more about Cuvva (including our milestones, press coverage and staff profiles), do some more research, or check out our Trustpilot page.

Can I tax a car with temporary car insurance?

Absolutely, you can use temporary insurance to tax your car or van once your policy details are reflected on the MID (Motor Insurance Database). While it can take up to 24 hours for these details to appear for the tax process, your insurance coverage is effective immediately if you book it to start instantly. For planning ahead, the app allows you to book your coverage weeks in advance - but a day’s cover should do the job when it comes to taxing the car.

Does the car need an underlying policy?

You can use temporary insurance to borrow or lend a car, but the car must be covered by an underlying policy - even if it's just parked up outside your house or in a garage in-between rides. Put simply, you can't just insure a car when you want to drive it, and leave it uninsured otherwise.

Can you get temporary car insurance on someone else’s car?

Yes, Cuvva is perfect for insuring yourself on someone else’s car, whether you’re borrowing a vehicle, ride-sharing, learning to drive with a provisional licence, or just want to get car insurance on a friend's car. Just remember, the policy is tied to the vehicle, not the driver - so you'll need to get a separate policy for each car you want to drive.

Is it better to get temporary car insurance or be added to someone’s policy?

It depends on how often you want to drive. If you plan on regularly using their car (let's say several times a week), it’s maybe worth crunching the numbers to see if it's cheaper to get added to their policy as a named driver. But this might make the owner’s premium go up, and puts their no claims bonus (NCB) at risk. If you are driving more occasionally, or want to protect the car owner’s premium or NCB, temporary insurance could be a better choice. It depends on your circumstances.

Can I use temporary insurance to drive my car to a MOT?

You can drive a car to a pre-booked MOT using temporary cover.

What do I do if I have an accident while I have temporary cover?

You should report all incidents within 24 hours of them happening, even if you're not going to claim. Here’s how.

How can you keep your insurance price down?

While personal factors like your age and claims history are most important, you might get a cheaper quote with a car in a lower insurance group or by timing your trip for when roads are quieter. The "Pricing Breakdown" tool in the app has more, or you can check out our top tips for cheaper car insurance.

I don’t have a UK licence, can I still get temporary insurance?

To use Cuvva, you can either use a UK licence or a full driving licence from Belgium, Bulgaria, France, Germany, Greece, Italy, the Netherlands, Poland, Portugal, the Republic of Ireland, Romania, Spain, or Sweden.

Any questions?

Got a question? Our tireless customer support team is on hand every single day of the year, between 9am and 9pm. Let's have a chat.

*Price paid by 10% of Cuvva customers. Terms apply.